The short answer is not yet. But we’re getting closer.

The AI boom has been unstoppable. New chips, smarter models, and trillion-dollar valuations everywhere you look.

Investors are calling it “the next internet,” but history is flashing a warning: we’ve seen this before.

From soaring AI stocks to parabolic charts that echo the 1999 dot com bubble, the similarities are hard to ignore.

So, will this AI boom end with a quiet correction or a full-blown tech crash?

Let’s dig into the charts, the hype, and what voices like Bill Gates and Fed Chair Jerome Powell really think about today’s AI mania.

The AI Boom Feels Familiar

The rise of artificial intelligence stocks looks similar to the 1999 bubble.

Back then, the internet was “the future”. Today, it’s AI.

In both cases, investors poured billions into unproven business models.

Back then, it was websites. Now, it’s data centers, chips, and algorithms.

Still, not all hype ends the same way.

Unlike the dot com boom, today’s AI leaders such as Nvidia, Microsoft, AMD, Amazon, and Alphabet are profitable and cash-rich.

That’s a big difference from the 2000 bubble, when many firms didn’t even have revenue.

Could We Still See a Parabolic Move First?

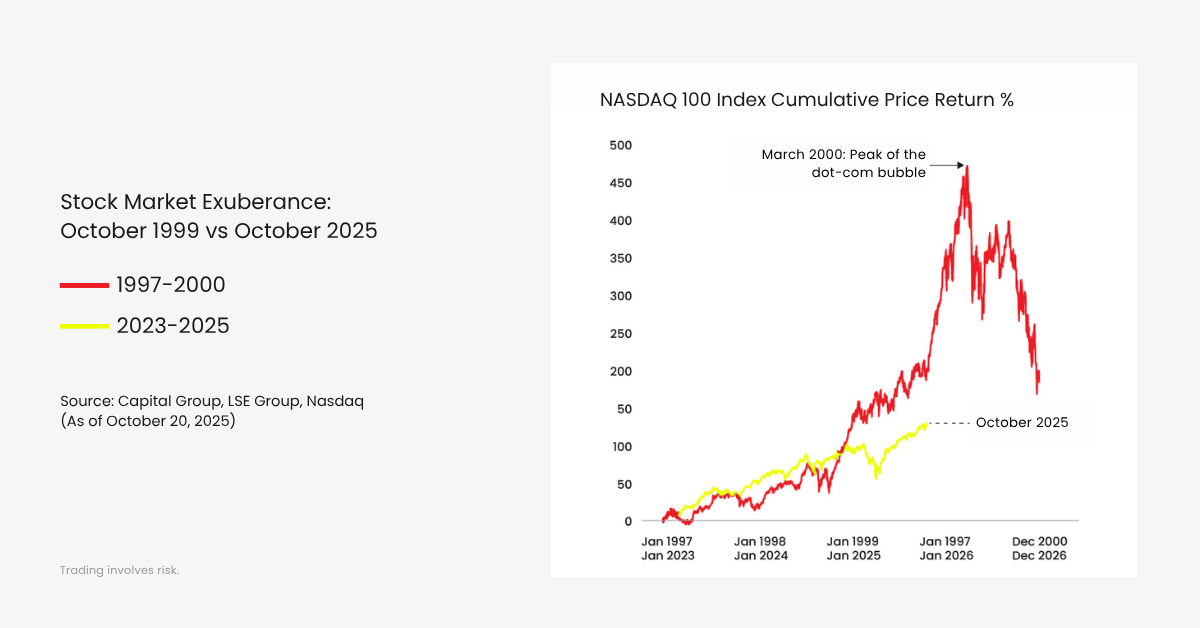

Look at this chart.

The current AI market rally still sits below the 2000 peak when compared to the dot com bubble.

That means we could see one huge parabolic move to the upside before a potential AI stock crash.

That’s exactly how the internet bubble behaved:

- Tech stocks doubled in the final months of 1999.

- Then, the tech crash erased 78% of the Nasdaq by late 2002.

So while we may not be at the top yet, the setup looks familiar. A melt-up before the unwind.

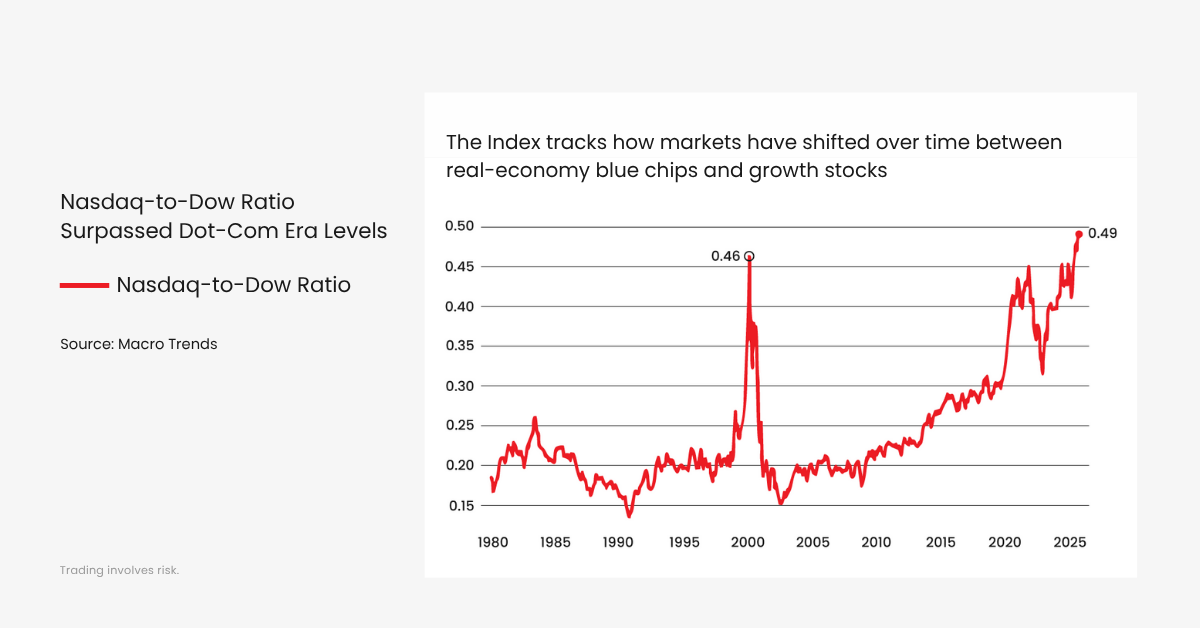

The Nasdaq vs. Dow Ratio: Déjà Vu of 2000

The Nasdaq-to-Dow ratio tells a clear story.

AI-driven tech stocks have massively outperformed industrial and financial names, just like during the dot com boom.

Whenever that ratio spikes this sharply, history shows a correction usually follows.

But again, there’s a nuance. The AI bubble is built on real infrastructure spending, not just dreams.

Cloud computing, AI data centers, and chip demand are creating tangible growth, not vaporware.

Still, investor concentration in the top AI stocks, mainly Nvidia, Microsoft, and AMD, could mean any slowdown hits fast and hard.

Bill Gates Warns of an Early AI Bubble

Even Bill Gates sees signs of a potential bubble forming.

In an interview this month, he said we’re in the “early stages of an AI bubble.”

His reasoning is that too many startups are chasing the same goal. They are building AI tools that might never turn a profit.

History says that when every company claims to be “AI-powered,” a shakeout usually follows.

But Gates also pointed out that this time, the winners will be enormous.

Just like Amazon and Google survived the dot com crash, a few best AI stocks could define the next decade.

In his words: “We’ll see failures, but the survivors will redefine everything.”

Powell Pushes Back: “AI Is Not a Bubble”

Federal Reserve Chair Jerome Powell disagrees.

He recently said AI is “not a bubble like the dot com era.”

His logic: productivity gains are measurable this time.

AI isn’t just hype, it’s driving real corporate investment, especially in automation, logistics, and software.

Powell’s view aligns with the Fed’s stance that the AI market boom is more structural than speculative.

In short: valuations are high, but fundamentals are stronger than 1999.

Still, bubbles often look rational right before they burst.

Why the AI Bubble Might Not Burst Yet

So, will the AI bubble burst?

Probably not right away.

History suggests that bubbles rarely die quietly.

They often end with a final blow-off phase, a euphoric rally before reality hits.

Right now, the market hasn’t shown that last phase yet.

Liquidity remains high, earnings from top artificial intelligence stocks are still growing, and retail FOMO hasn’t peaked.

In other words: the AI bubble burst may be coming, but the timing isn’t here yet.

We could see one more surge, especially if rate cuts arrive in 2025.

The Top AI Stocks Driving the Boom

If you pull up any AI stocks list, the same names dominate:

Nvidia, AMD, Microsoft, Alphabet, Amazon, and Meta.

Together, they make up a huge share of the S&P 500’s performance this year.

But that’s also the risk. If one cracks, the AI market crash could spread fast.

Investors are also piling into smaller Artificial Intelligence chipmakers and automation software companies, echoing the speculative wave of the dot com bubble.

Not all will survive.

How to Invest in Artificial Intelligence

If you’re wondering how to invest in artificial intelligence safely, think balance.

Instead of chasing parabolic moves, look for companies with real cash flow and product adoption.

Avoid overhyped names with little revenue, that’s where the bubble AI risk sits.

Diversification and patience matter more than timing the top.

As Gates hinted, the winners will likely become the next trillion-dollar giants.

But the road there will be volatile.

What Makes This Different from 1999

Despite the hype, there are crucial differences between now and the dot com bubble:

- Companies like Nvidia and Microsoft are profitable.

- AI adoption is already driving productivity.

- Global capital is more diversified.

Back in 1999, the internet was a promise.

Today, Artificial Intelligence is already an industry.

That doesn’t mean we’re safe. It just means the AI stock crash, if it comes, might look more like a rotation than a collapse.

Final Thoughts: A Bubble in Progress

So, is there an AI bubble?

Yes, but it’s still inflating.

Every revolution comes with speculation.

The 1999 bubble wiped out thousands of companies, yet it paved the way for trillion-dollar tech giants.

The Artificial Intelligence boom could do the same.

Some valuations will deflate, but innovation will outlast the noise.

We may be in the early innings of a bubble, not the end of one.

And if history repeats, the most painful corrections usually come after the biggest gains.

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the rapid and unpredictable fluctuation in the value and prices of these underlying financial instruments. This unpredictability is due to the adverse and unpredictable market movements, geopolitical events, economic data releases, and other unforeseen circumstances. You may sustain substantial losses including losses exceeding your initial investment within a short period of time.

You are strongly advised to fully understand the nature and inherent risks of trading with the respective financial instrument before engaging in any transactions with us. When you engage in transactions with us, you acknowledge that you are aware of and accept these risks. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.

Disclaimer

This information contained in this blog is for general informational purposes only and should not be considered as financial, investment, legal, tax or any other form of professional advice, recommendation, an offer, or an invitation to buy or sell any financial instruments. The content herein, including but not limited to data, analyses and market commentary, is presented based on internal records and/or publicly available information and may be subject to change or revision at anytime without notice and it does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance.

D Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and disclaim any and all liability for any direct, indirect, incidental, consequential, or other losses or damages arising out of or in connection with the use of or reliance on any information contained in this blog. The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction.

D Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. You should conduct your own research and consult with an independent qualified financial advisor or professional before making any financial, trading or investment decisions.